Take the Child and Dependent Care Tax Credit Another option is to increase withholdings from your own pay to cover nanny taxes at the end of the year. Going forward, remit your household employment taxes – including what you withhold from your employee’s pay – quarterly using Form 1040-ES. You could wind up owing too much in taxes and be hit with an underpayment penalty. If you haven’t been paying your nanny taxes throughout the year, you will owe this entire amount when you file your return.

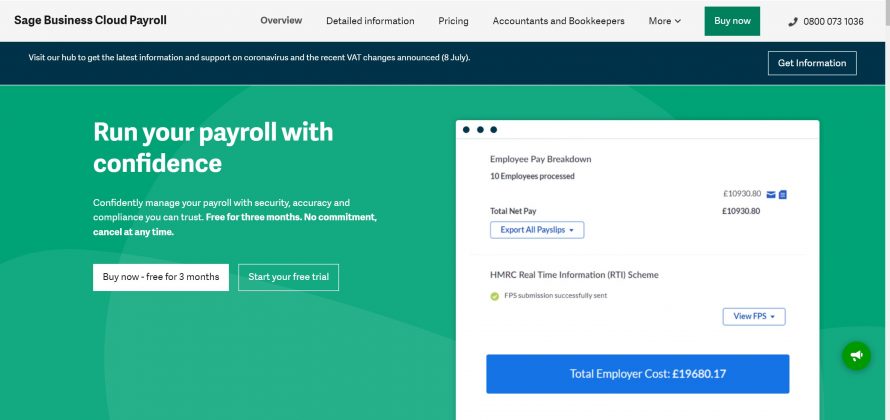

This is where you report the household employment taxes due to the IRS. File Schedule H With Your Personal Tax ReturnĪttach Schedule H to your personal tax return when you file. That could be considered tax evasion since you’re shifting your employer tax obligation to your nanny. As a reminder, nannies and other household workers are considered employees by the IRS and not independent contractors. Your nanny will need their Form W-2 by January 31 and you’ll file a copy of the W-2 and Form W-3 with the Social Security Administration by the same date. Unemployment taxes, however, are an employer-only responsibility. Your nanny will also owe the same amount in FICA taxes, which will also be due when they file their tax return. If you pay state unemployment taxes, you may be able to reduce your FUTA obligation to 0.6%. State unemployment (SUI) taxes vary but are typically several hundred dollars. Federal unemployment (FUTA) is 6% on the first $7,000 of your nanny’s wages. You’ll owe 7.65% of your nanny’s gross wages in FICA taxes, which will need to be paid when you file your personal tax return. Calculate Your Tax ObligationĪ household employer has two main tax responsibilities – FICA (Social Security and Medicare) and unemployment. Live-in nannies may not need to be paid overtime although rules vary by state. They should also be paid an overtime rate of time and a half for any hours worked over 40 in a workweek. Make sure your nanny is being paid at least the highest prevailing minimum wage of the federal, state, and local rates. If you’ve kept good payroll records, this shouldn’t be too much trouble. Figure Out How Much You Paid Your Nanny By Week

Does nannypay calculate futa taxes how to#

Check your state government website to find out how to get your state tax id. For the IRS, you can get your federal employer identification number (FEIN) online. If you haven’t done so already, step one is to get your tax identification numbers. Or if an employee made $1,000 in a calendar quarter you will owe federal – and possibly state – unemployment taxes. As long as that employee made at least $2,300 in 2021, you will have a nanny tax obligation (Social Security, Medicare, and potentially other responsibilities). Seasonal or temporary employees – like a summer or after-school nanny – can also be considered household workers. Household employees include nannies, senior caregivers, private educators and tutors, and caregivers in a nanny share. Put off your nanny taxes until now? Just realized you may have had a household employee last year? It’s not too late to get caught up with your nanny tax obligation and get things squared away with the IRS and your state tax agency.

0 kommentar(er)

0 kommentar(er)